Debt recycling is a powerful wealth-building strategy for property owners. It involves gradually replacing non-deductible debt, like a home loan, with tax-deductible investment debt.

If you’ve paid down a large portion of your home loan, you may be able to borrow that amount again using a separate loan split and invest it into income-generating assets like shares or investment property. Because the borrowed funds are used for investment purposes, the interest may be tax-deductible, offering potential savings.

The goal is to build a portfolio of assets that generate passive income while paying off your home loan faster. Unlike traditional saving, this approach can accelerate wealth creation, but it does come with risks that need to be understood.

This guide will help you understand how debt recycling works, who it suits, the risks involved, and how to get started.

What is Debt Recycling?

Debt recycling is the process of converting non-deductible home loan debt into tax-deductible investment debt. This allows homeowners to work towards being debt-free while simultaneously growing a portfolio of income-producing investments.

Under a standard mortgage, your repayments reduce the loan balance, but the interest is not tax-deductible. While this can lead to full ownership of your home, it doesn’t help you grow additional wealth unless the property increases in value.

Debt recycling restructures this approach. Each time you reduce your home loan, you can borrow the same amount again through a new loan split and invest it into assets that produce income. This way, you’re redirecting equity into investments that may generate returns and offer tax deductions on interest.

If these investments produce income, that money (along with any tax savings) can be redirected to further reduce your home loan. Interest-only loans are often used for the investment portion to maximise cash flow, allowing borrowers to pay down their home loan faster with the freed-up funds.

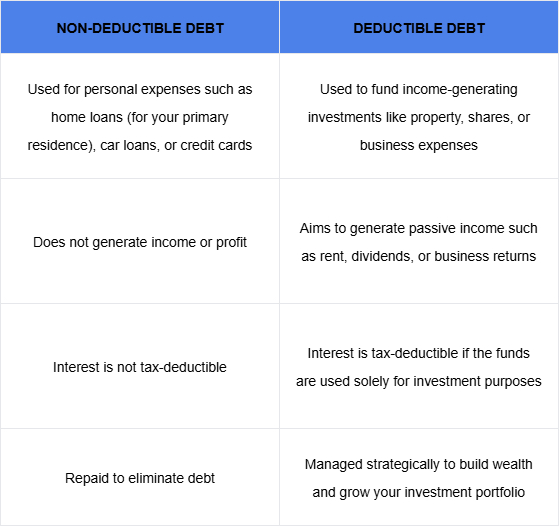

Knowing the difference between non-deductible and deductible debt helps you manage your cash flow more effectively and make smarter financial decisions.

How Debt Recycling Works

If you’re a property investor focused on strengthening your long-term financial position, debt recycling could be a powerful strategy. It allows you to reduce non-deductible home loan debt while building wealth in a tax-effective way.

The process involves a series of intentional steps, starting with building equity in your home, then using that equity to invest in income-producing assets.

Let’s get into the details of how it works.

1. Make Extra Repayments to Build Equity

To begin, you need to create equity, which is the portion of your home’s value you own outright. You can do this by making extra repayments using savings, an offset account, or proceeds from asset sales.

2. Access the Equity Using a Split Loan or Line of Credit

Once you’ve built sufficient equity, the next step is to access it for investment. This is best done by either:

- Setting up a separate loan split attached to your home loan, or

- Establishing a line of credit facility.

This structure keeps your investment borrowings separate from your original home loan, which is crucial for maintaining the tax deductibility of interest on the new loan.

Avoid using redraws for mixed purposes, as this can complicate or even disqualify tax deductions.

3. Invest the Borrowed Funds into Income-Producing Assets

The borrowed funds are then invested into assets that generate assessable income. Common options include:

- Investment properties

- Shares or ETFs

- Managed funds

- Fixed-income investments

To qualify for tax deductions on the loan interest, the investment must produce income. Capital growth alone does not meet this requirement.

4. Claim the Interest on the Investment Loan as a Tax Deduction

If the loan is structured correctly and used exclusively for investment purposes, the interest is tax-deductible.

For example, if you borrow $100,000 for investing and pay $6,000 in annual interest, someone on a 39% tax rate could save around $2,340 per year in tax.

5. Reinvest and repeat

As your investments generate income and tax savings, use those funds to make further repayments on your non-deductible home loan. This builds more equity, which you can then borrow against again for future investments.

Over time, this creates a compounding effect, gradually converting personal debt into tax-efficient investment debt while building your asset base.

Case Study: How Tom Restructured His Finances

Tom has a total debt of $650,000: $350,000 on his home loan (non-deductible) and $300,000 on an investment loan (deductible). Because the interest on his home loan isn’t tax-deductible, every dollar he pays in interest comes directly out of his after-tax income.

Tom focuses his savings on aggressively paying down his home loan to improve his financial position. Meanwhile, he maintains the investment loan, as the interest on it is tax-deductible, which helps offset some of the cost.

By directing surplus funds toward his non-deductible mortgage, Tom reduces his monthly repayments over time and improves his overall cash flow. This freed-up cash allows him to reinvest more effectively.

The income he earns from his investments is then used to further reduce his home loan, which increases his equity. As his equity grows, Tom can borrow again through a loan split and reinvest in additional income-producing assets, continuing the debt recycling cycle and steadily building long-term wealth.

Who Is Debt Recycling Best Suited For?

Debt recycling works best for financially stable individuals who have built up equity in their home and are committed to a long-term wealth-building strategy. Here’s who it’s most suitable for:

1. Homeowners with Sufficient Equity

To implement debt recycling, you must own a property with a reasonable amount of equity. This equity becomes the foundation of the strategy, allowing you to borrow against it for investment purposes. Without equity, the strategy cannot move forward.

2. Property Owners with Stable Cash Flow

Consistent, predictable income is essential. You need to comfortably meet your home loan repayments while managing a new investment loan. Debt recycling is typically better suited for:

- Salaried professionals

- Business owners with steady revenue

- Dual-income households

If your income is highly variable or uncertain, the risks may outweigh the benefits.

3. High-Income Earners

Those earning $135,000 or more per year are particularly well-positioned to benefit from this strategy. Since the interest on investment loans may be tax-deductible, people in higher tax brackets can generate substantial tax savings, lowering the effective cost of borrowing and boosting investment returns.

4. Risk-Tolerant Investors

Debt recycling involves investing borrowed money into assets like shares, managed funds, or investment properties. These investments can fluctuate in value, which means you need to be comfortable with market ups and downs. A level-headed approach and willingness to adjust when needed are key.

5. Long-Term Planners

This is not a quick-win strategy. Debt recycling is a gradual, compounding approach that typically plays out over 10 years or more. The long-term goal is to steadily reduce non-deductible debt while growing an income-producing asset base that supports your financial independence.

Benefits of Debt Recycling for Property Investors

For property investors, debt recycling is a powerful strategy that can transform personal debt into long-term financial gains. Here are the key advantages:

- Accelerated Wealth Creation Through Compounding Returns: By reinvesting investment income and using tax savings to reduce your home loan, you can grow your wealth more efficiently. Over time, this creates a compounding effect where your money works harder for you year after year.

- Tax-Deductible Interest on Investment Loans: When you convert a portion of your home loan into an investment loan, the interest becomes tax-deductible provided the borrowed funds are used for income-producing assets. This helps reduce your taxable income while continuing to build equity.

- Improved Cash Flow Through Tax Efficiency: Tax deductions on investment loan interest can improve your cash flow. With more available funds, you can choose to reinvest, pay down your non-deductible debt faster, or meet other financial goals.

- Passive Income from Investments: Investments made through debt recycling, such as rental properties, shares, or managed funds, can generate passive income. This adds another stream of revenue, which you can use to accelerate mortgage repayments or grow your investment portfolio.

- Flexible Loan Structuring: Using split loans or a line of credit allows you to clearly separate your home loan from your investment debt. This not only simplifies tax reporting but also gives you better control over your repayments and cash flow management.

Potential Risks and What to Consider

While debt recycling can be an effective strategy for building long-term wealth, it also carries important risks. Understanding these risks is essential to making an informed decision:

- Market Volatility: Investments can rise and fall in value. Even if your investments underperform or generate no returns, you’re still required to meet your loan repayments. That’s why it’s critical to assess your financial position and ensure you have the capacity to service debt during market downturns.

- Rising interest rates: If interest rates increase, the cost of servicing your investment loan also rises. This can reduce your cash flow and impact your ability to make repayments or continue investing. Always factor in rate increases when planning your debt recycling strategy.

- Over-Leveraging and Poor Investment Choices: Taking on too much debt or making poor investment decisions can seriously damage your financial position. It’s important to start with manageable amounts, have a clear investment plan, and regularly review your portfolio. Debt recycling is best suited to those with a solid financial foundation, strong budgeting habits, and a long-term mindset.

- Complexity and Compliance: Debt recycling involves careful loan structuring and strict separation between personal and investment borrowings to ensure interest deductibility. A poorly structured setup may lead to lost tax benefits or even ATO scrutiny.

With the right financial advice and risk management, debt recycling can be a powerful tool. Work closely with your mortgage broker and financial adviser to ensure your strategy aligns with your goals, risk tolerance, and long-term financial plan.

How to Get Started with Debt Recycling

Debt recycling can be a powerful way to grow wealth while paying down your home loan. A well-structured approach also allows for diversification across different asset classes, helping you spread risk and build a balanced investment portfolio.

If you believe debt recycling aligns with your financial goals, here’s a step-by-step guide to get started:

1. Assess Your Financial Position

Start by reviewing your income, expenses, existing debts, and borrowing capacity. Understand your cash flow and determine if you can comfortably take on additional borrowing. This ensures you’re not overextending yourself and are in a strong position to manage both your home loan and investment loan.

2. Set Up a Split Loan or Line of Credit

Work with your broker to set up a split loan or line of credit. This allows you to clearly separate your home loan (non-deductible) from your investment loan (deductible), making it easier to track and claim interest deductions.

Avoid using redraw facilities, as they can blur the purpose of funds and affect tax deductibility.

3. Build Equity Through Extra Repayments

To create usable equity, direct extra repayments into your mortgage. You can do this through lump sums, regular additional repayments, or offset account savings. The more equity you build, the more you can borrow to invest.

4. Invest Borrowed Funds in Income-Producing Assets

Once equity is available, borrow against it and invest the funds into assets that generate assessable income, such as:

- Shares or ETFs

- Managed funds

- Investment properties

Only invest in assets that produce income, as this is what allows the loan interest to be tax-deductible. This step is where your wealth-building journey accelerates.

5. Claim Interest Deductions and Reinvest

The interest on your investment loan may be claimed as a tax deduction, improving your overall cash flow. Use the investment income and tax savings to make extra repayments on your home loan, increasing your equity and enabling you to repeat the process.

6. Monitor and Adjust Regularly

Debt recycling is a long-term strategy and requires regular reviews. Markets shift, interest rates move, and your personal situation may change. Ongoing monitoring and adjustments are key to managing risk and staying aligned with your financial goals.

Speak with your broker or financial adviser to ensure your structure is compliant and effective. At Zenith, our team can guide you through the process and tailor a debt recycling strategy to fit your goals and risk profile.

Is Debt Recycling the Right Strategy for You?

Debt recycling can be a powerful tool for building long-term wealth, but it’s not the right fit for everyone. While it offers tax benefits and the potential to grow your investment portfolio, it also carries risks and requires a stable financial foundation.

Before including debt recycling in your financial plan, consider the following key factors:

- Income Level: You’ll need a reliable income to manage both your home loan and investment loan repayments. This is why debt recycling is often better suited to higher-income earners, particularly those in higher tax brackets who can maximise the benefits of interest deductions.

- Risk Tolerance: Debt recycling involves borrowing to invest, which carries investment risk. If markets drop or interest rates rise, your asset values may fall or your repayments may increase. You need to be comfortable with potential fluctuations in both cash flow and investment performance.

- Property Equity: You must have sufficient equity in your home to borrow against for investment purposes. The more equity you’ve built, the more you can access and reinvest. Without equity, debt recycling isn’t possible.

- Time Horizon: Debt recycling is not a short-term fix. It’s a strategy designed for a long-term horizon, ideally 10 years or more. If you’re planning to sell your home soon or don’t have a long-term investment plan, it may not be the best fit.

Debt recycling is best suited to individuals with high and stable incomes, a strong appetite for long-term investing, sufficient home equity, and the ability to manage risk.

Speak to our experienced home loan specialists to find out how we can work alongside your accountant or financial adviser to structure a tailored debt recycling plan that fits your goals.

Frequently Asked Questions

1. Is debt recycling safe?

Debt recycling can be financially rewarding, but it does carry risk. Because it involves borrowing to invest, you’re exposed to market fluctuations and potential interest rate rises. The safety of the strategy depends on your financial stability, ability to manage repayments, and comfort with risk.

2. Can I use debt recycling with an owner-occupied home?

Yes. Debt recycling is commonly done using equity from your principal residence. As long as there is available equity, you can borrow against it to invest in income-producing assets, while keeping the original home loan separate.

3. Are the investment returns guaranteed?

No, like any investment, returns are not guaranteed. If the market underperforms, you may be left with an investment loan but no corresponding income. This is why it’s essential to have a strong financial buffer and assess your ability to service the loan even during downturns.

4. Do I need a financial planner or mortgage broker?

Ideally, both. A financial planner helps develop an investment strategy aligned with your goals and risk profile. A mortgage broker structures the loans correctly, ensuring separation between personal and investment debt, and helps maximise potential tax benefits.

5. What type of loan works best for debt recycling?

Interest-only loans are often preferred for the investment component. They reduce your monthly repayments, freeing up cash to pay down your non-deductible home loan faster while allowing you to invest for long-term growth.